Thank you to our Sponsors

Tax Stamp & Traceability Forum 2022 Malta – A Review

The Tax Stamp and Traceability Forum™ (TSTF) returned as an in-person event in May 2022 with 194 registrants from 99 organisations and 35 countries.

Access to the presentations is limited to TSTF 2022 attendees, please use the password which was provided by the [email protected]

These figures are slightly lower than previous years, reflecting both a recovery in conference attendance and the challenges facing some delegates in getting into Malta because of COVID-related restrictions.

The conference was organised into eight sessions spanning two full days plus a pre-conference workshop day. With refreshments served in an exhibition with 23 booths there was ample time for meetings and discussions. A number of key themes emerged in the presentations and exhibits at the conference, and these are summarised hereunder.

Digital security printing

Digital security printing emerged as a key theme at TSTF 2022, with both a conference session and a pre-conference workshop. With an exhibition presence and presentations from HP Indigo Secure, Komori, De La Rue JetSecure, Luminescence Sun Chemical Security, and Xeikon, the field was well represented. Integration of digital security printing into a secure workflow was also covered in presentations by the Authentication Solution Providers’ Association (ASPA) and Jura.

It was noted in one presentation that digital is ‘a world to discover’, and from the wide range of systems on show this did seem to be the case. To counter this, another presentation noted that ‘trust is needed on top of technology’. TSTF 2022 proved to be a good forum to explore these issues and the breadth of digital security printing solutions that are available for programmes to support excise taxation.

TSTF 2022 extended this topic into digital marking where it was noted in presentations by SICPA and OPTEL that different solutions may be needed for tax stamps and direct marking. This breadth of solutions was illustrated with reference to novel materials for taggants by Stardust Materials and Quantum Base. In this case, these materials can be incorporated into inks for both analogue and digital printing.

Physical/digital solutions

The combination of physical and digital features was another key theme for TSTF 2022. A case study describing the tax stamp solution of Liberia, a relatively new user of this technology, was given by Madras Security Printers, where an element of digital verification is associated with physical tools and devices. The Liberia programme also has a component of population preparation – ‘how much stakeholder engagement is too much?’ is a great proposition.

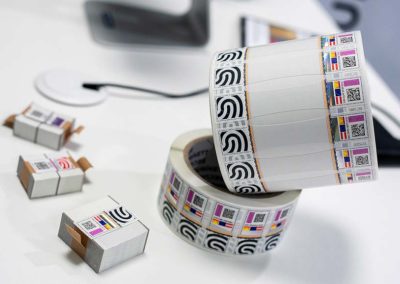

In terms of features, QR codes were covered by U-NICA and Securikett, visible digital seals by LEONHARD KURZ and Securikett/Advanced Track & Trace, and physically unclonable functions by U-NICA.

Smartphones for verification

Country solutions featuring smartphones were presented for Georgia, Chile, Portugal (presented by the International Tax Stamp Association) and Malta (presented by OpSec Security). As presented by Madras Security Printers, in Liberia the smartphone is a compelling platform as 80% of the population has access to a basic smartphone but only 40% has internet access.

Company solutions were presented by De La Rue, OPTEL, KURZ, Jura, Nanografix and SICPA, illustrating the breadth of alternatives available for tax stamp and traceability programmes.

One element of the use of smartphones for authentication explored at TSTF 2022 was their use across inspectors and consumers. Substantial examples were presented on their use for inspectors and the evidence here appears compelling. Contrary to this, there was little evidence presented of significant use by consumers.

Other electronic technologies

In addition to the smartphone platform, other electronic technologies featured strongly at TSTF 2022. For cannabis solutions in particular, Metrc cited the use of RFID to control the whole value chain, whereas SICPA emphasised the importance of marking retail packaging with secure stamps featuring a QR code for smartphone interaction, which provides access to relevant documentation and certificates, secured via a blockchain.

Blockchain/distributed ledger solutions also featured in presentations by Securikett and Quantum Base. This topic opened out into presentations on artificial intelligence and machine learning from OPTEL and Internet of Things from KURZ.

Sustainability

Sustainability was noted as a driver in a number of presentations, notably those of OPTEL, Securikett, Alan Hodgson Consulting and ASPA. Sustainability has become a strong political and social driver to industry and ours will be no exception. A number of relevant technologies featured in this debate.

Direct marking was noted as having the additional benefit of contributing to sustainability – printed barcodes can be used not just for track and trace solutions but to also contribute to sustainability by marking the packaging for recycling.

The topic of recycling was also mentioned from a digital perspective, where tags embedded in or placed on a product can be used to identify the materials used in packaging.

International standards

The benefits of participation and the relevance of international standards in the tax stamp and traceability market was the subject of significant discussion both from conference presentations and in the exhibition. Various aspects of these were covered by Securikett, Kenya Revenue Authority, KURZ, Alan Hodgson Consulting and Reconnaissance International. Some of the key standards pertinent to our industry are due for review in 2023 and delegates were reminded to look out for the commencement of this process.

Extension into other areas

The conference cited many other market sectors that could benefit from tax stamp and traceability programmes. Some are already under way at country level and others are in the planning stage. TSTF 2022 proved to be a great forum for the exchange of ideas and relevant case studies in this area.

The debate on extension was started by Nicola Sudan as Conference Director at the beginning of the conference and continued by OpSec Security when describing the Malta tax stamp programme. Following on from this, SICPA, ASPA, and Kenya Revenue Authority described further ideas on extension for revenue enhancement.

Throughout TSTF 2022, ideas were shared on areas of extension ranging from cement to sugar, but out of these ideas two specific areas kept reappearing. The revenue opportunities from cannabis products were the subject of an entire session in the Forum and they were described as ‘an industry in search of normal’. Vaping was described by the Canadian Bank Note Company as set to be as big an opportunity as cannabis.

The Framework Convention on Tobacco Control (FCTC) also deserves a mention here as it featured in a number of debates, notably with presentations by De La Rue and SICPA.

Collaborative working

Supporting and initiating collaborations is one of the deliverables of meetings such as TSTF 2022 and after a long gap there was a palpable sense of these being built into discussions in and around the forum sessions. Presentations from the Kenya Revenue Authority and the Jura/HP Indigo Secure collaboration illustrated these well. It will be interesting to see what further programmes come out of these debates.

The sharing of information is another deliverable from these events. The University of Cape Town presented an economic model that creates a cost/benefit analysis in financial terms that is transferrable to other markets. This sharing of relevant information is what a forum is all about.

Networking

After a long gap caused by the pandemic, the community present at TSTF 2022 was ready to meet again in person for real face-to-face discussions. There were multiple opportunities for networking at this meeting, opportunities that were much missed over the last few years. The exhibition, lunches and receptions were well attended as delegates took advantage of these.

The exhibition, in particular, gave the opportunity to touch, feel and see actual solutions, materials and print. For the younger members of our community, this was seen as a key learning experience. It also reinforced the sense of trust that comes from face-to-face interaction, the basis for future collaborations.

With refreshments and lunches sponsored by Jura/HP Indigo Secure, receptions sponsored by SICPA, Madras Security Printers and KURZ, and an outdoor conference dinner sponsored by OpSec Security, the networking was well supported. As noted by Conference Director Nicola Sudan, these opportunities bring a renewed sense of connection with the industry.

It was announced at the end of the conference that the next Tax Stamp & Traceability Forum will be held in Tbilisi, Georgia in September 2023.

Hungarian Banknote

Optel Group

Rwanda Revenue Authority

Gallery

Click on any picture to see the full gallery.

Portuguese Mint – Imprensa Nacional Casa da Moeda

Botswana Revenue Authority

De la Rue

Attendees

Advanced Track & Trace

France

Afghanistan Revenue Department

Afghanistan

Alan Hodgson Consulting

UK

Angstrom Technologies, Inc

USA

ApiraSol

Germany

Ashton Potter

USA

Authentix

USA

Baldwin Vision Systems

USA

Bundesdruckerei

Germany

Canadian Bank Note Company

Canada

Cartor Security Printing

France

Centro Interamericano de Administraciones Tributarias

Panama

Chan Wanich Security Printing

Thailand

Crane Currency

USA

D&H Sahar Impex

India

De La Rue

UK

Dentsu Tracking

Switzerland

Domino

UK

Drewsen Spezialpapiere

Germany

Excise Department

Thailand

Flint Group

Belgium

FMA Secure

Chile

Garsu Pasaulis

Lithuania

Georgia Revenue Service

Georgia

GTS

Germany

Heidelberger Druckmaschinen

Germany

Homsetra Optics

China

HP Indigo Secure

USA

Hungarian Banknote Printing Company

Hungary

International Tax Stamp Association

UK

Istituto Poligrafico e Zecca dello Stato Italiano

Italy

Japan Tobacco International SA

Switzerland

Jordan Customs

Jordan

JT International Holding BV

Netherlands

JT International SA

Switzerland

JURA JSP

Hungary

Kenya Revenue Authority

Kenya

Koenig & Bauer Banknote Solutions

Switzerland

Lake Image Systems

UK

LEONHARD KURZ

Germany

Lesotho Revenue Authority

Lesotho

Liberia Revenue Authority

Liberia

Luminescence Sun Chemical Security

UK

Madras Security Printers

India

MGS Business Consultants

India

Ministry of Economy and Finance

Panama

Ministry of Finance

Poland

Ministry of Finance, Afghanistan

Afghanistan

Ministry of Finance, Ethiopia

Ethiopia

MOZAIQ Switzerland

NanoGrafix

France

Office of the Permanent Secretary

Thailand

Office of the Revenue Commissioners

Ireland

OpSec Security

UK

OPTEL Group

Canada

Pantec

Switzerland

POLAR-Mohr

Germany

PWPW

Poland

Quantum Base

UK

Rwanda Revenue Authority

Rwanda

Schwarz Druck

Germany

SCRIBOS

Germany

Securikett

Austria

Security Fibres

UK

Servicio de Impuestos Internos

Chile

SICPA

Switzerland

Smurfit Kappa Security Concepts

Ireland

Sri Lanka Customs

Sri Lanka

Stardust Materials

USA

Thai Customs Department

Thailand

The Playing Cards Factory, Excise Department, Thailand

Thailand

Thomas Greg & Sons

Colombia

U-NICA Solutions

Switzerland

Uganda Revenue Authority

Uganda

University of Cape Town

South Africa

Wista Werkzeugfertigungs

Germany

ZEISER

Germany

Kenya Revenue Authority

Manipal Technologies

Sri Lanka Customs

Programme

Access to the presentations is limited to TSTF 2022 attendees, please use the password which was provided by the [email protected]

Monday 16 May 2022

09:00 – 12:30 Closed Workshop for Revenue/Customs Authorities Only: Hosted by International Tax Stamp Association

The International Tax Stamp Association (ITSA) is hosting a closed meeting for revenue and other government authorities, as well as ITSA members, which allows the authorities to come together for more intimate discussions before the conference begins.

13:30 – 17:00 Workshop: Security Printing in the Digital Age

Dgital printing technologies are finding an ever-increasing role in the production of secure documents, particularly in areas that require low setup costs and the individualisation of documents with unique or sequential features. This is seeing the development of digitally-specific security print design features. What are they and how do you incorporate them in to your security document?

Before adopting digital printing for your secured documents you need to consider its characteristics, the consumables available for digital printing and the supporting design and pre-press software available – as well as how you might integrate with traditional analogue printing. You also need to consider the easy availability of digital printers and how its output compares against the output of the specialist equipment being developed for security printing.

This workshop will examine the characteristics of these specialist digital printers for secured documents, with information on security inks for digital printing, feature design software, printing hardware and real-life applications. It will also take a big-picture look at the opportunities and threats arising from these printer developments.

The workshop will feature presentations from equipment, software and ink suppliers as well as a company already offering digitally printed documents, to ensure that you get clear, detailed and practical information on the possibilities and options of using high-end digital systems for security documents.

All those registering for this workshop will receive a complimentary digital copy of Reconnaissance’s new publication Printing Beyond Colour: Commercial Innovations for Security Print, worth £250. This 60-page review offers informative technical analyses of latest generation inks and digital printing techniques and how these could be adapted and applied to the security world.

18:30 Welcome Reception

Tuesday 17 May 2022

Hover on the presentation title or speaker to see if more information is available.

Session 1 – Welcome and Overview

09:00

Welcome and Forum Overview

Nicola Sudan

Tax Stamp & Traceability News™ (UK)

09:10

From Grapes to Oil – Balancing Synergy and Customisation in the Expansion of Malta’s Digital Tax Stamp Programme

David Thomas

OpSec Security (UK)

09:30

Successful Implementation for Liberia and its State-of-the-Art Track and Trace Solution

Asir Ratan Singh

Madras Security Printers (India)

09:50

Tracking and Tracing of Tobacco Products: Lessons Learned and Best Practices

Juan Carlos Yañez Arenas

International Tax Stamp Association (UK)

10:10

Using a Simulation Model to Determine Break-even Cost of Track and Trace

Dr Hana Ross

University of Cape Town (South Africa)

10:30 Session Q&A

10:45 Break – Refreshments

Session 2 – Broadening the Scope / FCTC Protocol

11:05

Digital Tax Stamp Solutions for the WHO FCTC Protocol to Eliminate Illicit Trade

Nasser Bakkar

De La Rue (UK)

11:25

Broadening the Scope of Traceability Solutions with Continuously Evolving Technologies

Ruggero Milanese

SICPA (Switzerland)

11:45

Covert Traceability of Tax Stamps Through Taggant Barcoding

Dr Vitaly Talyansky

Stardust Materials (Estonia)

12:05

Beyond Compliance: Digital Tax Stamps in High-Speed Production Markets

Dr Foued Barouni

OPTEL Group (Canada)

12:25 Session Q&A

12:40 Lunch

13:40 Session 3 – Panel Discussion – Cannabis and Securing the Entire Supply Chain

Francisco Mandiola – FMA Secure – Chile – Chair

During this ‘coffee table’ panel, solution providers and other stakeholders discuss how countries should deal with the high tax-earning potential of cannabis versus cigarettes/alcohol. They also compare different seed-to-sale authentication and track and trace mechanisms for protecting against illicit trade and complying with government regulations.

15:10 Break – Refreshments

Session 4 – Digital Seals / Digital Security Printing

16:10

Does a Visible Digital Seal Solve the Market Requirement for Anti-Copy and Anti-Cloneable Codes?

Michael Ritschewald

LEONHARD KURZ (Germany)

16:30

See the Unseen – A Look into Level 2 Security on Tax Stamps

Gerben van Wijk

Luminescence Sun Chemical (UK)

16:50 Session Q&A

17:05 Extended Exhibition Viewing

18:30 Gala Dinner

Wednesday 18 May 2022

Session 5 – Monitoring and Enforcement / Interoperability

09:00

Well-Designed Tax Stamps Help Combat Illegal Alcohol and Tobacco Supply

Aqthar Hassen

Sri Lanka Customs (Sri Lanka)

09:40

Flexibility Through Interoperable Functional Units

Dr Marietta Ulrich-Horn

Securikett (Austria)

10:20 Session Q&A

10:35 Break – Refreshments

Session 6 – Innovations / Technologies

10:55

Digital Variable Embossing of Holographic Images Revolutionises Anti-Counterfeiting

Dan Lieberman

Nanografix (USA)

11:15

Serial Numbers, Barcodes and Covert Security Features on Tax Stamps

Erwin Wagner

Baldwin Vision Systems (USA)

11:35

Phygital Security Feature Innovations on Tax Stamps in India

Chander Shekhar Jeena

Authentication Solution Providers’ Association

11:55

Q-ID: A Simple Solution to Tax Stamp Security Using Quantum Technology

David Howarth

Quantum Base (UK )

12:15 Session Q&A

12:30 Lunch

Session 7 – Country Cases

13:50

Fiscal Traceability in Chile to Reduce Indirect Tax Evasion

Fernando Barraza

Former Chilean Tax Commissioner (Chile)

14:10

Tax Stamp Developments in the Pan-Latin American Region

Francisco Mandiola

FMA Secure (Chile)

14:30

Digital Transformation of Tax Administration in Georgia

David Chitaishvili

Revenue Service (Georgia )

14:50 Session Q&A

15:05 Break – Refreshments

Session 8 – Looking Ahead

15:30

Emerging Technologies – Threats and Opportunities

Dr Alan Hodgson

Consultant in Printing and Imaging (UK)

15:50

International Standards for Tax Stamps: Present and Future

Ian Lancaster

Reconnaissance International (UK)

16:10 Session Q&A

16:25 Closing Remarks and Farewell Drinks

Sponsors

Thank you to our 2022 Sponsors and Exhibitors

Many thanks to the following sponsors and exhibitors for taking part in our wonderful exhibition running alongside the conference:

Platinum – Madras Security Printers

Diamond – OpSec

Gold – Authentix, De La Rue, Jura JSP – HP Indigo Secure, SICPA, Stardust

Silver – Baldwin, KURZ, Luminescence Sun Chemical Security, OPTEL, Security Fibres UK

Exhibitors – DREWSEN SPEZIALPAPIERE, INEXTO, Lake Image – Domino, Pantec, Polar, Securikett, Thymaris, U-NICA, Wista – GTS, Xeikon, ZEISER