Attendee's Geolocation

2019 Review

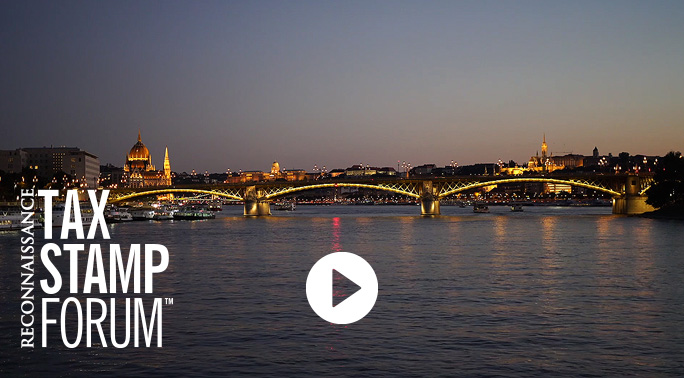

Tax Stamp Forum Goes Back to Where it All Began

This year the Tax Stamp Forum turned 10 years old, and to mark this milestone anniversary, we thought we’d return to where it all began 10 years ago, by holding the 2019 forum in the same city. And we have to say that it was great to be back!

The forum kicked off with a brief introduction by Astrid Mitchell, Chief Executive, Reconnaissance, who took us on a journey through the different locations that have played host to the event over the last decade.

After Budapest in 2009, the forum moved to London in 2011, and then across the pond to Washington DC in 2012. It then came back to Europe in 2013, in Vienna, before heading off to Dubai in 2014, then back over the Atlantic to Miami a year later, and Berlin in 2017. The 2018 event was a milestone in that it was held for the first time on African soil, in Nairobi, Kenya. And now back to Budapest this year.

This gives a total of nine forums – as opposed to 10 – given that up to now they have been held every 15 to 18 months.

You will see that we have endeavoured, in general, to cover locations where there is interest in and activity around excise tax stamp programmes. However gaps remain, particularly in respect of Asia and Latin America, and we do need to look at bringing future forums to these regions, especially given the extensive tax stamp activities taking place there – and also given that Tax Stamp Forum is a global event which needs to be globally present.

As Astrid Mitchell commented in her opening remarks at this year’s event, ‘although we use the words ‘tax stamp’ to describe this forum it covers so much more than the stamp itself. The stamp is a component of a much broader ecosystem for excise collection, product authentication, secure track and trace and production monitoring.’

She continued, ‘we would like to think that, with all that’s been going on, at international level in particular, with the FCTC Protocol and EU Tobacco Products Directive, that when we were setting up the Tax Stamp Forum 10 years ago, we saw all these developments coming. But to be honest we didn’t really, it just sort of happened, but I’m glad that we were fortunate to be there at the right place and right time in order that we can now be of service to those concerned by these developments.’

Attendance Honours List

To mark the 10-year anniversary, Astrid presented an ‘honours list’ of 10 delegates who had attended the first forum in 2009 and who were also present at this forum 10 years later. And out of those 10 delegates, two were identified as having attended all nine forums: Pat Fitzmaurice of DLR Security Concepts and Kelly Smith of Ashton Potter. Astrid congratulated these longstanding delegates and as a token of appreciation for their continuing support presented them with a bottle of Pálinka, the local Hungarian fruit brandy, complete, of course, with a tax stamp.

Some Stats

The 2019 event was attended by just under 240 attendees from 50 countries and 116 different organisations. In addition, around 25 government organisations from across the world were in attendance, mainly consisting of tax revenue authorities. These included authorities from Guyana, Chile, Israel, Poland, Rwanda, Kenya, Uganda, Georgia, European Commission, Pakistan, Bangladesh, Sri Lanka, Mauritius, Botswana, India, Thailand, Italy, Spain, Ireland, Taiwan, Moldova, Lesotho, Romania and of course the host nation, Hungary.

Georgia here we Come

To kick off the next 10 years of the Tax Stamp Forum, we are pleased to announce that Georgia Revenue Service has invited us to hold the next event in Tbilisi, Georgia. We are also happy to advise that from now on we will be holding the forum on a 12-month cycle, therefore the date for the Tbilisi forum will be October 2020. So please mark your diaries now!

And one other change to announce is that Tax Stamp Forum will now be called:

Tax Stamp & Traceability Forum™

This change is in line with the fact that, as Astrid said above, it’s not just about tax stamps.

On a final note, Reconnaissance would like to express its sincere thanks to the 13 sponsors, 21 exhibitors, 35 speakers and panellists, government authorities and all other delegates, for making the 10th anniversary Tax Stamp Forum an event to remember.

THANK YOU!

Hungarian Banknote

Optel Group

Rwanda Revenue Authority

Portuguese Mint – Imprensa Nacional Casa da Moeda

Botswana Revenue Authority

De la Rue

Attendees

Advanced Track & Trace (ATT)

France

Agencia Tributaria

Spain

Agencija za Komercijalnu Djelatnost (AKD) d.o.o.

Croatia

Agenzia delle Dogane

Italy

Agfa NV

Belgium

Allexis s.r.o

Slovakia

Alvarez & Marsal Corporate Transformative Services

United Kingdom

Antares Vision SpA

Italy

ANY Security Printing Company PLC

Hungary

Arjo Solutions

France

Ashton Potter Security Printers

USA

Association of European Cancer Leagues

Belgium

Authentication Solution Providers Association (ASPA)

India

Authentix Inc

USA

Axess Technologies Ltd.

United Kingdom

BALDWIN | Vision Systems

USA

Baldwin Technology Ltd

United Kingdom

Bangladesh Tariff Commission (BTC)

Bangladesh

Beijing Boda Green High-Tech Limited

China

BM Grob Consulting

United Kingdom

Botswana Unified Revenue Service

Botswana

Bundesdruckerei GmbH

Germany

Canadian Bank Note Company Ltd

Canada

Cartor Security Printing

France

Center of Information Technologies in Finance, Republic of Moldova

Moldova

Chan Wanich Security Printing Co. Ltd

Thailand

DATA. UA

Ukraine

De La Rue

United Kingdom

Department of Excise Entertainment & Luxury Tax Govt. of Delhi

India

Drewsen Spezialpapiere GmbH & Co. KG

Germany

European Commission – Taxation and Customs Union

Belgium

Fair-trade Independent Tobacco Association

South Africa

Federal Board of Revenue – Pakistan

Pakistan

Flint Group UK

Belgium

FNMT (Fabrica Nacional de Moneda y Timbre – Real Casa de la Moneda)

Spain

Garsų Pasaulis UAB

Lithuania

Gietz AG

Switzerland

Goebel GmbH

Germany

Government of NCT of Delhi

India

Graphimecc Group S.r.l.

Italy

Guyana Revenue Authority

Guyana

Heidelberger Druckmaschinen AG

Germany

Henan Province Wellking Technologies Co, Ltd

China

Hewlett Packard Indigo

France

HoloGrate JSC

Russia

Hueck Folien GmbH

Austria

Hungarian Banknote Printing Shareholding Company

Hungary

Industrial Innovation Group

Ukraine

Inexto SA

Switzerland

Intergraf

Belgium

IQ Structures

Czech Republic

Istituto Poligrafico e Zecca dello Stato S.p.A.

Italy

Journalism Development Network

Bosnia and Herzegovina

JT International SA

Switzerland

Jura JSP GmbH

Austria

KBA-NotaSys SA

Switzerland

Kenya Revenue Authority

Kenya

Koenig & Bauer AG

Germany

Korea Security Printing & Minting Corp (KOMSCO)

South Korea

La Poste

France

Lake Image Systems Ltd

United Kingdom

Leonhard Kurz Stiftung & Co KG

Germany

Lesotho Revenue Authority

Lesotho

Luminescence SunChemical Security

United Kingdom

Luminochem KFT

Hungary

Madras Security Printers Private Limited

India

Manipal Technologies Limited

India

Mauritius Revenue Authority

Mauritius

Ministry of Finance – Israel Tax Authority

Israel

Ministry of Finance – Poland

Poland

Ministry of Finance – Taiwan

Taiwan

Ministry of Finance – Thailand

Thailand

Ministry of Mineral Resources and Energy

Mozambique

National Security Ventures FZE

United Arab Emirates

National Tax and Customs Administration of Hungary (NTCA)

Hungary

Nolax AG

Switzerland

Operator-CRPT

Russia

OpSec Security Group

United Kingdom

OPTEL Group (Ireland)

Ireland

Papeteries De Vizille

France

Percetakan Nasional Malaysia Berhad

Malaysia

Peruri

Indonesia

Philip Morris International Management S.A.

Russia

POLAR-Mohr

Germany

Polish Security Printing Works (PWPW)

Poland

Portuguese Mint – Imprensa Nacional Casa da Moeda SA

Portugal

QualiTV

Israel

Red Nacional Antitabaco RENATA

Costa Rica

Revenue Commissioners – Ireland

Ireland

Revenue Service of Georgia

Georgia

Rwanda Revenue Authority (RRA)

Rwanda

Schwarz Druck GmbH

Germany

SECOIA Executive Consultants AG / Ltd

Switzerland

Securikett Ulrich & Horn GmbH

Austria

Security Fibres UK Limited

United Kingdom

Security Print Solutions

United Kingdom

Servicio de Impuestos Internos – Chile

Chile

SICPA SA

Switzerland

Smurfit Kappa Security Concepts

Ireland

Sovereign Border Solutions

South Africa

SPM – Security Paper Mill a.s.

Czech Republic

Sri Lanka Customs

Sri Lanka

ST Securities Limited

United Kingdom

SURYS

France

Systech International

USA

The Excise Department – Thailand

Thailand

Thomas Greg & Sons de Colombia SA

Colombia

Toppan Europe GmbH

Germany

Tullis Russell Coaters Limited

United Kingdom

Uganda Revenue Authority

Uganda

Venture Global Consulting

USA

VerifyMe Inc.

USA

William Consultant Co. Ltd

Thailand

Worldline

Belgium

ZEISER GmbH

Germany

Kenya Revenue Authority

Manipal Technologies

Sri Lanka Customs

Programme

Wednesday 11 September

9:00 – 12:00

Closed Meeting for Government Authorities Hosted by International Tax Stamp Association

The International Tax Stamp Association (ITSA) will be hosting a closed meeting for government authorities only, thereby giving them the opportunity to meet each other for more intimate discussions before the Tax Stamp Forum begins.

Workshop 1

Workshop 2

14:00 – 15:30

Back to Basics: What is a Tax Stamp?

Ian Lancaster of Reconnaissance International takes us through the answers to some basic but important questions.

- What are tax stamps and why do we use them?

- How are they made and what are they made of?

- Why do they need protecting?

- How are they protected?

- Why serialise and track and trace them?

- How do we do this?

- What is the difference between track and trace and secure track and trace?

- What are the relevant international standards that apply to tax stamps?

- What are the most cost-effective ways of producing tax stamps?

16:00 – 17:30

Back to Basics: Core Principles for the Governance and Operating Model for Track and Trace

Michael Eads and Telita Snyckers of Sovereign Border Solutions take us through the principles of secure track and trace and automated production monitoring systems, with the following focus areas:

- Governance models;

- Independence from tobacco industry, as per the WHO FCTC Protocol;

- Model contracts for track and trace solutions and procurement options (eg. PPP, concession agreements, straight procurement).

Thursday 12 September

Hover on the presentation title or speaker to see if more information is available.

Presentation is available for download, click on the icon to access the download page.

Session 1: Dawn of a New Landscape

09:10

Welcome and Opening Remarks

Colonel Kristóf Péter Bakai

National Tax and Customs Administration (Hungary)

09:20

The Current State of Affairs: Illicit Trade Levels, and New Regulations, Standards and Technologies

Nicola Sudan

International Tax Stamp Association (United Kingdom)

09:40

Why Tax Stamp Programmes do not Always Reach Their Full Potential – and What We Can Do to Fix this

Telita Snyckers

Sovereign Border Solutions (South Africa)

Session 2: Getting Ready for International Regulations

11:30

Gearing up for an Effective, FCTC-Compliant Tobacco Control Solution

Ruggero Milanese

SICPA (Switzerland)

12:10

The Cost of Security -possibilities for finding cost-effective security solutions

Géza Imre

ANY Security Printing (Hungary)

Session 3: Panel Discussion including Q&A

13:50

The FCTC is Coming

Chair:

Adrian Stone, ST Securities (United Kingdom)

Panellists:

- Aftab Baloch, Formerly Federal Board of Revenue (Pakistan)

- Luk Joossens, Association of European Cancer Leagues (Belgium)

- Michael Eads, Sovereign Border Solutions (South Africa)

- Michal Zuzula, Allexis, (Slovakia)

Session 4: New Tax Stamp/Traceability Initiatives from Around the World

15:35

Think Ink: the Role that Innovative Inks can Play in Securing Tax Stamps

Gerben van Wijk

Luminescence Sun Chemical Security (United Kingdom)

15:55

Digital Tax Administration

Elguja Loliashvili

Georgia Revenue Service (Georgia)

Davit Chitaishvili

Georgia Revenue Service (Georgia)

16:15

Traceability in Tobacco Products and Unique Identifiers: the Spanish Case

Luis Gavira Caballero

Ministry of Finance (Spain)

Carlos Gómez Gómez

FNMT-RCM (Spain)

16:35

The Future of the Tax Stamp as a Tool for ALL Government Agencies

Karambu Muthaura

Kenya Revenue Authority (Kenya)

16:55

Introducing Tax Stamps for Liquor and Liquor-Based Products: the Sri Lankan Experience

Aqthar Hassen

Sri Lanka Customs (Sri Lanka)

Friday 13 September

Session 5: Digital Printing, Blockchain and the Full Tax Stamp Lifecycle

09:20

Can Tax Stamp be Printed 100% Digitally and Achieve Level of Security Required?

Jeroen Van Bauwel

Xeikon (Belgium)

09:40

Modular Tax Stamp Solution for Revenue Protection – Added Value for Taxation Authorities

Michael Ritschewald

LEONHARD KURZ (Germany)

10:00

How is Blockchain Impacting Secure Track and Trace, and what if Covert Security Alone was Enough?

Sven Bergmann

Venture Global (USA)

Session 6: Pharma, Fuel and Country Cases

11:10

Security Printing Solutions Traceability Age: the Italian Bollino for Pharmaceutical Products

Enrico Colaiacovo

Istituto Poligrafico e Zecca dello Stato (Italy)

11:30

The Mozambique Oil Marking Experience

Berta Macamo

Autoridade Tributaria de Mocambique (Mozambique)

11:50

The Role of an Electronic Tax Stamp System in Supporting the Industrial Economy and Boosting Revenue in Tanzania

Abdul Yussufu Mapembe|Innocent Minja

Tanzania Revenue Authority (Tanzania)

12:10

Adaptive Traceability – Implementation of Malta’s Digital Tax Stamp and TPD Solution

David Thomas

OpSec Security (United Kingdom)

12:30

Update on Rwanda’s Digital Stamps with Tracking System

R Asir Ratan Singh

Madras Security Printers (India)

Session 7: Codes and Foils

14:10

UniQode: A Machine-Readable System for Unique and Unclonable Excise and Tax stamps

Nuno Gonçalves

Imprensa Nacional-Casa da Moeda (Portugal)

14:30

The Innovative Application of Linear and Cross-Striping Security Foils for Tax Stamps

Bernhard Grob

Rotary Logic (United Kingdom)

14:50

The New Cigarette Tax Stamp implementation in Chile

Victor Villalon

Servicio de Impuestos Internos (Chile)

Session 8: Studies and Standards

16:20

Key Learnings – Hit and Miss Trends and Developments in Tax Stamps in India

Chander Jeena

Authentication Solution Providers' Association (India)

16:40

Streamlining of Tax Stamp Procurement with Intergraf’s ISO 14298

Doris Schulz-Pätzold

Intergraf (Belgium)

Cartor Security Printing

Mauritius Revenue Authority

SURYS

Sponsors

Thank you to our 2019 Sponsors and Exhibitors

Many thanks to the following sponsors and exhibitors for taking part in our wonderful exhibition running alongside the conference:

Platinum – Madras Security Printers

Gold – ANY Security Printing Company, Authentix, De La Rue, Hungarian Banknote Printing Company, Jura JSP, Opsec, SICPA, SYSTECH

Silver – Allexis s.r.o, FNMT, Luminescence Sun Chemical Security, Security Fibres UK

Exhibitors – Advanced Track & Trace, AGFA Graphics, ArjoSolutions, Baldwin, Bundesdruckerei, DREWSEN SPEZIALPAPIERE, Gietz, Graphimecc, HP Indigo, ITSA, Istituto Poligrafico e Zecca dello Stato Italiano, Lake Image Systems, Luminochem, OVD Kinegram / KURZ, Papeteries De Vizille, Polar, Securikett, SPM – Security Paper Mill, Wellking Technologies Co. Ltd, ZEISER